|

|

|

Welcome to our Friends weekly e-mail.

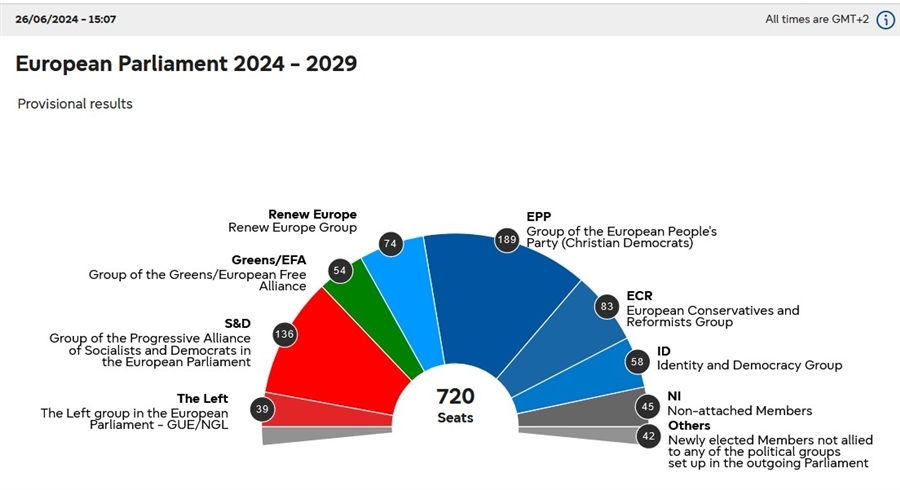

Highlights of my week: Jockeying for membership of the Parliament’s `political families’ continued apace as the EPP strengthened its leading position and Renew slipped decisively into third place behind ECR. But that ranking in the Parliament was not enough to secure Italian PM Meloni a seat at the top table sorting out EU top jobs – which may be confirmed late today. The European Council also has to agree on the Strategic Agenda for the EU for the next five-year term. Naturally financial market participants will focus on the attention given to CMU and the final completion of banking union - highlighted by Commissioner McGuiness at Bruegel. The incoming Commission President will flesh out these polices in a manifesto that will be the basis of the Parliament’s approval of the candidate. Both EFAMA and ISDA set out their case for specific measures. The CEPR’s Cecchetti published an interesting paper on the implications of central bank losses from QE operations but he did not highlight the dramatic situation created in the UK by QE losses and the index-linking of interest on a quarter of public debt. In the past three years, interest costs have risen permanently by an amount substantially great than the entire defence budget! As the UK election draws to its conclusion, the City seems to be hoping for a re-set in relations with the EU but the EU-UK Forum’s Oberg was clear the EU will be guided by what is in its best interests Graham Bishop Articles from 21-27 June 2024

Policy impacting Finance

Invitation letter by President Charles Michel to the members of the European Council : View Article

EURACTIV's Brzozowski, Pugnet : EU leaders expected to agree on Von der Leyen, top jobs despite lingering resistance : EU leaders are expected to nominate on Thursday (27 June) incumbent European Commission President Ursula von der Leyen for a second term as part of a top jobs deal, but some lingering resistance is still expected to be part of the negotiations. View Article

EPC's Maurice: The EU’s future after the 2024 elections: Making the Strategic Agenda more strategic : During their European Council meeting on 27-28 June 2024, the EU’s 27 heads of state and government will adopt the Union’s Strategic Agenda for 2024-2029. It will be the third time they do so, after 2014 and 2019. But the stakes are higher this year. View ArticleCER's Czaky: Will Hungary's presidency rock the EU? : The Hungarian presidency will have limited impact on EU policies – but the hit to the Union’s reputation could be significant. The Council of the EU’s rotating presidency is often described as ‘responsibility without power’. View Article

POLITICO: The Hungarian presidency: Let the games begin : Brussels holds its breath as Budapest takes over rotating Council presidency. View Article

Council: EU opens accession negotiations with Ukraine : The EU today held the first Intergovernmental Conference at ministerial level to open accession negotiations with Ukraine. View Article

Fondation Robert Schuman's Kuleba: Ukraine's EU accession brings added value and serves historical justice : Now that Ukraine's EU accession process has begun, it is critical to discuss the broader historical significance of EU enlargement as well as some very practical benefits that Ukraine's membership will bring to Europe[1]. View ArticleEurogroup, 20 June 2024 : IMF Artice IV review of euro area and discussion of international role of the euro View Article

Update on recent Eurogroup work: Eurogroup President Donohoe’s letter to the President of the European Council : CMU statement – towards implementation and delivery: Eurogroup .. delivering on the measures outlined in our statement, given the 2024 Euro Summit statement to “regularly take stock of the performance and evolution of European capital markets and report on the progress of the identified measures”. View Article

Commissioner McGuinness at Bruegel event, 'Europe's banking union at 10: unfinished yet transformative' : ..we really need Banking Union relate to citizens in the way that when there's a crisis it's very real when banking has its problems, that people have problems.. This topic was not on the agenda, and yet it's absolutely pivotal, as is Capital Markets Union. View Article

EFAMA: Decisive shift in policies is required to mobilize private savings towards the EU economy : A growing share of equity UCITS is invested in US assets. By the end of 2023, 44.6% of the portfolio of equity UCITS were invested in US assets, compared to 19.2% in 2012. View Article

ISDA's O'Malia: Supporting EU Strategic Priorities : Tackling those challenges can’t be achieved without having strong, liquid capital markets that support financing, investment and risk management – which means a well-functioning derivatives market is an important part of the puzzle. View Article

FSUG calls for action: Financial services should work for the benefit of citizens : 1. revitalising the CMU: Despite some progress, EU citizens still lack sufficient access to suitable financial products. The FSUG recommends measures to facilitate access to simple, cost-efficient and Pan-European investment products and also to enhance consumer and investor protection rules View Article

ECB reports on progress towards euro adoption : View Article

CEPR's Cechetti, Hilscher: Fiscal consequences of central bank losses : This column develops a framework for understanding the medium- and long-run implications of the losses arising from these large-scale asset purchases, and argues that they are best viewed as a form of fiscal policy View Article

Banking Union EBA: Profitability of EU banks remains resilient although the sector is confronted with materialising credit risks : ...credit risks have started materialising with an increase in non-performing loans during the first quarter. The majority of banks surveyed expect further asset quality deterioration in CRE, SMEs loans and consumer credit in the next 6-12 months. View Article

AFME welcomes the publication of the EU implementation of final Basel III standards and stresses the need for jurisdictional coordination : AFME supports the EU Commission’s decision to activate the delegated act for the Fundamental Review of the Trading Book (FRTB), which is highly relevant to ensure a more consistent timeline for the FRTB implementation across the world. View Article

ESBG: BCBS public consultation on the revised assessment framework for global systemically important banks (G-SIB) : The World Savings and Retail Banking Institute (WSBI) recently submitted its response to the Basel Committee on Banking Supervision public consultation on potential revisions to the assessment methodology for global systemically important banks (G-SIB). View Article

Capital Markets Union ISDA responds to FSB consultation on liquidity preparedness for margin and collateral calls : The response notes that the recommendations are generally sensible and seek to incorporate a proportionate and risk-based approach. It also highlights a number of considerations relevant to the non-bank financial intermediation (NBFI) sector’s liquidity preparedness for margin and collateral calls. View Article

GFIA warns IAIS against ‘disproportionate’ focus on climate risks : GFIA is especially concerned on what it considers an, ‘excessive focus on climate risk in corporate governance, remuneration and risk management’ in comparison to the wide range of other risks facing the industry. View Article

OECD: PENSION MARKETS IN FOCUS Preliminary 2023 data - June 2024 : Pension assets grew in 2023, partly offsetting 2022 losses: • Assets earmarked for retirement rose in 2023 thanks to the investment gains that pension plans earned on their bond and equity holdings; View Article

Accountancy Europe: European Single Access Point (ESAP) – What do auditors need to know? : The point of reference for EU Capital Market Information View Article

PensionsEurope’s answer to the ESMA’s consultation on amendments to the Credit Rating Agencies Regulation : In our answer, we explain that we broadly agree with the amendments proposed by ESMA. However, we still highlight that credit rating agencies should provide more detailed explanations about their methodological approach, rather than only identifying them. View Article

Environmental, Social, Governance (ESG) Project Syndicate's Tubiana: What Does the EU Election Mean for European Climate Policy? : Although the far right's latest electoral gains were not driven primarily by an opposition to climate policies, they will have deleterious effects on Europe's green transition over the next five years. The immediate lesson for climate campaigners is that they have a messaging problem. View Article

GFANZ: Statement from Michael R. Bloomberg, Mark Carney and Mary L. Schapiro on IFRS announcing it will take on work to support guidance on : The IFRS Foundation’s decision to begin work to support the disclosure of firms’ transition plans under IFRS S2 is a welcome step forward. View Article

ICMA feedback on the application of Paris-aligned Benchmarks (PAB) exclusions to sustainable bond investments under the recent ESMA Guidelin : ICMA has given feedback on the application of Paris-aligned Benchmarks (PAB) exclusions to sustainable bond investments under the recent ESMA Guidelines. View Article

BETTER FINANCE: European Financial Supervisors Listen to Investors and Propose Simplified Categories for SFDR : The ESAs proposal aims to empower retail investors by advising the Commission to replace the existing ‘Article 8’ and ‘Article 9’ disclosure rules with appropriate categories that better reflect retail investor interest and understanding of sustainable financial products. View Article

ICMA: The Principles announce guidance for green enabling projects and guidelines for Sustainability-Linked Loan financing Bonds (SLLB) alon : The Principles are the global standard for the $5 trillion sustainable bond market that represents the largest source of market finance dedicated to sustainability and climate transition, available internationally to corporates , financial institutions, supranationals, agencies and sovereigns. View Article

CFA: Private Markets: Governance Issues Rise to the Fore : New CFA Institute member survey finds mixed views on need for additional regulation but clear support for improved governance and disclosures View Article

Fin Tech Regulation finextra: Digital euro would maintain freedom to choose how Europeans pay - ECB : With Europe inching towards the issuance of a digital euro, the ECB has embarked on a charm offensive, taking to media outlets across the continent to reassure citizens that the new payments option will compliment, not replace, cash and provide them with greater freedom of choice. View Article

ALFI responds to the ESMA consultation on requirements of MiCA on detection and prevention of market abuse, investor protection and operatio : In the response to the ESMA consultation, ALFI conveyed the views and most relevant feedback from the investment funds industry perspective, reflecting the consensus view of the Luxembourg Fund Industry Association membership, with respect to the four different aspects covered. View Article

Economic Policies Impacting EU Finance Bruegel's Darvas , Welslau, Zettelmeyer : The implications of the European Union’s new fiscal rules : This policy brief summarises the main features of the new European Union fiscal framework View Article

Brexit and the City POLITICO's Brenton: City dreams of Labour win to deliver new Brexit deal : It’s considered a ‘hanging offense,’ but could some EU countries hash out side deals with the UK on financial services? View Article

Brexit FT: UK must stop ‘walking on eggshells’ about EU trade, business group to warn : British Chambers of Commerce will urge next prime minister to deepen ties with bloc in order to boost growth View Article

EU-UK Forum's Oberg: Beyond the TCA and Brexit - is the EU interested in a closer relationship with the UK? : ...I dare to suggest that the UK leaving the EU has to some extent long-term strengthened the unity of the EU bloc. Thirdly, that what is going to be the scope of cooperation in the future will be predominantly guided by the European Union’s rather than the UK’s interests. View Article

UKTPO's Suraj: Who’s promising what on international trade in the 2024 General Election? : The UK is the fourth largest exporter of goods and services, so it is particularly important to shine light on the next government’s stance for developing a robust trade policy that maximises the benefits of trade consistent with domestic policy objectives. View Article

Chatham House's Gasiorek: The UK’s main political parties both need to talk about EU trade : Neither party is saying enough about international trade in their election proposals, with discussion of UK–EU trade a striking omission. View Article

Follow us on

|

© Copyright 2024 Graham Bishop |