SRB Working paper: In the 2023 banking turmoil in the U.S. and Switzerland authorities managed to preserve financial stability - but a discussion on the effectiveness of the post GFC prudential frameworks started, .. identifying some implementation issues in bank crisis management regimes.

In the midst of banking crises, policymakers often find themselves grappling with the truth of the saying «once the toothpaste is out of the tube, it is awfully hard to get it back in». Restoring confidence in financial systems and containing the repercussions of financial instability prove to be daunting challenges.

In the 2023 banking turmoil in the U.S. and Switzerland authorities managed to preserve financial stability, however a discussion on the effectiveness of the post Global Financial Crisis prudential frameworks started, in particular identifying some implementation issues in bank crisis management regimes.

In our work, we refer to the EU’s crisis management framework, examining some implementation lessons that the 2023 banking turmoil can provide to EU resolution authorities. The paper also explores potential regulatory and implementation changes to enhance the framework’s effectiveness in managing banking crises in the European Union.

We focus on three aspects: (i) the interplay between deposit insurance and resolution, (ii) the need for optionality and flexibility in resolution tools, and (iii) the design of an effective public sector liquidity backstop. We find that some further improvement could be achieved in the management of banking crises in Europe: (i) deposit insurance schemes should play a more decisive role in funding resolution; (ii) optionality remains key to successful crisis management, which implies that in the Banking Union resolution planning for large and medium sized banks could be based, where necessary and adequate, not only on bail-in tool but also on transfer tools, as a viable alternative or in combination with the former one; (iii) the backstop mechanism which will become available in the Banking Union may not be sufficient in some liquidity tail scenarios affecting large banks. We argue that a public funding backstop in the form of a guarantee, underpinned by the EU budget, would represent a robust and effective European solution.

1. The 2023 banking turmoil: the main findings and initial lessons for prudential regulation, supervision and resolution

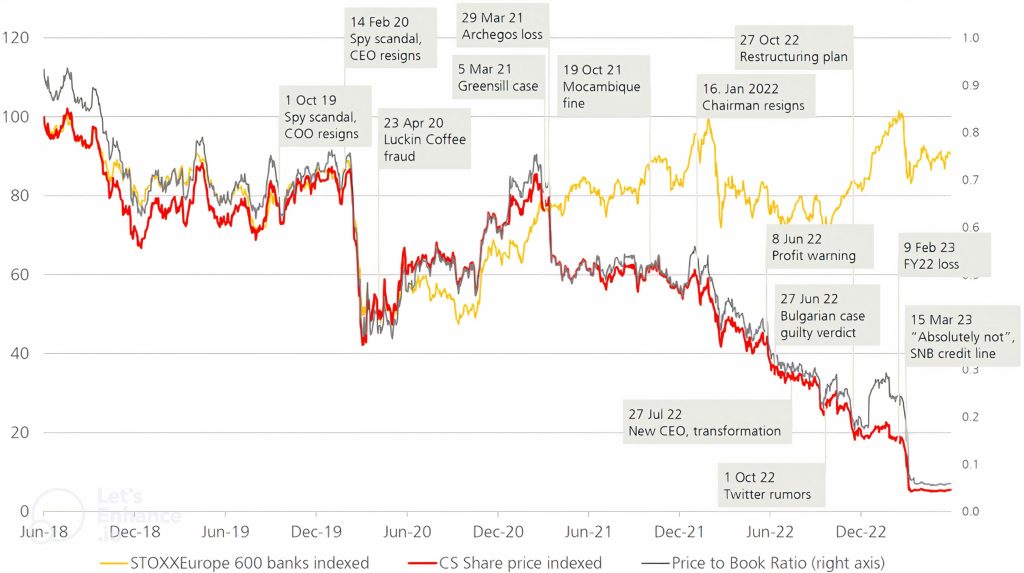

The March 2023 banking turmoil marked the most significant financial market disruption since the 2008-2009 Great Financial Crisis (GFC). It began with the collapse of Silicon Valley Bank (SVB) and other regional American banks. The uncertainty created by the crisis spread to Europe, ultimately leading to the downfall of Credit Suisse—a G-SIB characterised by long-standing poor performance and negative track record outcomes, casting doubt on the sustainability of its business model—culminating in its acquisition by UBS.

The 2023 banking turmoil has prompted new discussions on the adequacy and implementation effectiveness of the prudential and resolution frameworks introduced after the GFC. International standard setters have initiated an evaluation of the events, drawing preliminary conclusions.1

As concerns prudential regulation and supervision, the key takeaway is that the root cause of the recent bank failures on both sides of the Atlantic was poor governance, deficiencies in fundamental risk management practices, and unsustainable business models. In some cases, these were exacerbated by weak application of the international standards. Merely imposing higher capital and liquidity requirements cannot ensure a bank’s profitability if its business model is not viable.

The failed US regional banks showed indeed: (i) common balance-sheet fragilities, fuelled by excessive risk-taking and inadequate risk management practices, ultimately threatening firms’ solvency, and (ii) exacerbated maturity mismatch (for the US banks, long term assets funded with short term liabilities, in particular large amounts of uninsured deposits, plus large unrealised losses on securities held at amortised costs), amplified by digitalisation and social network dynamics, triggering deposit runs. As concerns the shortcomings in regulation and supervision, since 2018, the US regulation for medium-sized banks had been revised, exempting them fully or partially from certain requirements.2

Improved supervision is crucial to identify and challenge poor strategic decisions, governance, and risk management that lead to weak business models. Additionally, authorities must fully utilize all available tools, including sanctions, to enforce timely corrective measures and ensure adequate supervisory resources in both quality and quantity.3

On prudential regulation, the Basel Committee will engage in focused analytical work to evaluate whether specific elements of the Basel framework functioned as expected during the turmoil—such as the application and calibration of liquidity standards, the proper implementation of interest rate risk measures in the banking book, the treatment of held-to-maturity assets, and the role of AT1 capital. This assessment may guide the exploration of policy options for the medium term.

In terms of crisis management, the review of the FSB upholds the appropriateness and feasibility of the framework, identifying at the same time a number of implementation issues for global and other systemically important banks. Among the positive aspects, resolution planning and capabilities, as well as the build-up of sufficient loss absorbency capacity, proved useful and provided an executable alternative to the solution preferred by the authorities in the case of Credit Suisse. In addition, cross-border cooperation and crisis communication within the core Crisis Management Groups (CMG) worked well and allowed for thorough contingency planning in the build-up of the crisis.

Concerning the implementation issues, the most important are: a) communication and coordination of information among authorities, even beyond the authorities involved in the CMGs; b) choice of resolution strategies and optionality of resolution tools; c) consideration about the features of an effective public sector funding backstop; d) implementation of the bail-in tool cross border; d) consideration of the resolution of banks that could be systemic in failure; e) the interplay among bank runs, uninsured deposits and the role of deposit insurance and resolution.

Chart 1. Credit Suisse – market indicators*

Notes: *Reproduced from the Swiss Report of the Expert Group on Banking Stability (2023).

2. What lessons from the turmoil for EU Resolution Authorities?

SUERF

© SUERF

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article